Finally, a post in the tutorial section. Its been ages since I wanted to do a post here and am very relieved that finally its happening. I may be little rusty here so please excuse me.

Just a little recap before we proceed. So far we have covered many candlestick patterns;

Single Candlestick Patterns

Multi-Candlestick Patterns

Final installment of these candlestick patterns was remaining which we will visit today. It is Bullish / Bearish Engulfing.

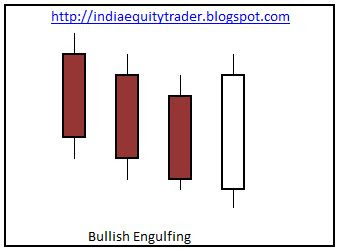

Bullish Engulfing

It is very simple to understand pattern which usually occurs at the end of a downtrend and indicates reversal. It is characterized by multiple Black candles followed by a big White candle which fully covers the previous black candle. Important to note here is that the opening (bottom) of white candle is below the closing (bottom) of previous day black candle. Also closing (top) of white candle is above the opening (top) of previous day black candle.

This patterns indicates the change in the market sentiment and usually generates a reliable buy signal.

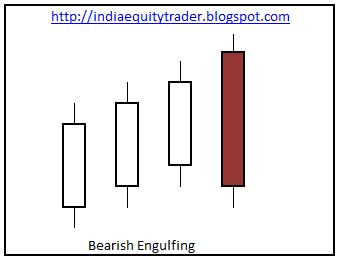

Bearish Engulfing

Need I say more.

This pattern indicates end of an uptrend and reversal in market sentiment. It indicates imminent downtrend and usually a good time to go short. It is worthwhile to note that the strength of the new direction of the market depends on how big the new candle (white in bullish engulfing or black in bearish engulfing) is and how much below or above it opened and how much above to below it closed respectively with respect to previous day's candle.

One example of bearish engulfing is SBI. During mid April when SBI was at around 2300 level, bearish engulfing appeared changing the ongoing trend. In a months time SBI reached levels of 1800.

Acting only on the basis of such engulfing is usually very difficult. One needs to corroborate such signal with other indicators and at times with fundamentals and current news about the stock. More on the comprehensive trading scenario later.

This probably is the final post on this blog address. I plan to move all these posts to Options Blog or some other blog which I will decide next month. There I will consolidate tutorials, technical indicators, charts, fundamental posts and trading posts. It will be easier for me to manage that way and will help me stay consistent in writing.

As usual, will wait for your comments.

No comments:

Post a Comment