Morning Star

Morning Star is a three candlestick bullish reversal pattern. It is found at the end of a downtrend. The first candle is a long black (or red) candle indicating a day belonging to bears where stock saw the negative price movement as per the continuing trend. Second candle is again a black candle indicating another negative day but this time body is not as long and but the shadows are long indicating indecision in the market. Third day confirms the reversal by being a white (or green) candle indicating bulls taking over control. See below.

The strength of the reversal is judged by two things. The volumes of the trade on the third day and the length of the white candle with respect to the black candle of the first day. If the white candle of the third day is reaching or going up more than the half of the first day black candle; it is considered very bullish.

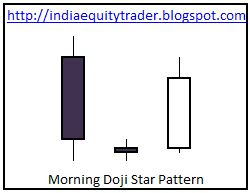

Morning Doji Star

Morning Doji Star is as you can guess is similar to above pattern with only difference being the middle candle is a (black or white) Doji instead of a simple black candle. See below.

Morning Doji Star is considered a stronger bullish reversal pattern. Example of Morning Doji Star above is from the weekly chart of CNX IT Index. The Morning Doji Star was formed around August at a level of approximately 5100. Since then it had gone up to a level of 6300 (almost 25% gain) by mid October. What more can I say...

This is as far as Morning Star / Morning Doji Star. In the next post, we will see Evening Stars. In between these two... have a wonderful day.

No comments:

Post a Comment